Overview of Financial Markets Today

Today’s financial markets are dynamic, with constant shifts influenced by technology and global events. These markets include stocks, bonds, commodities, and currencies, each responding to different stimuli.

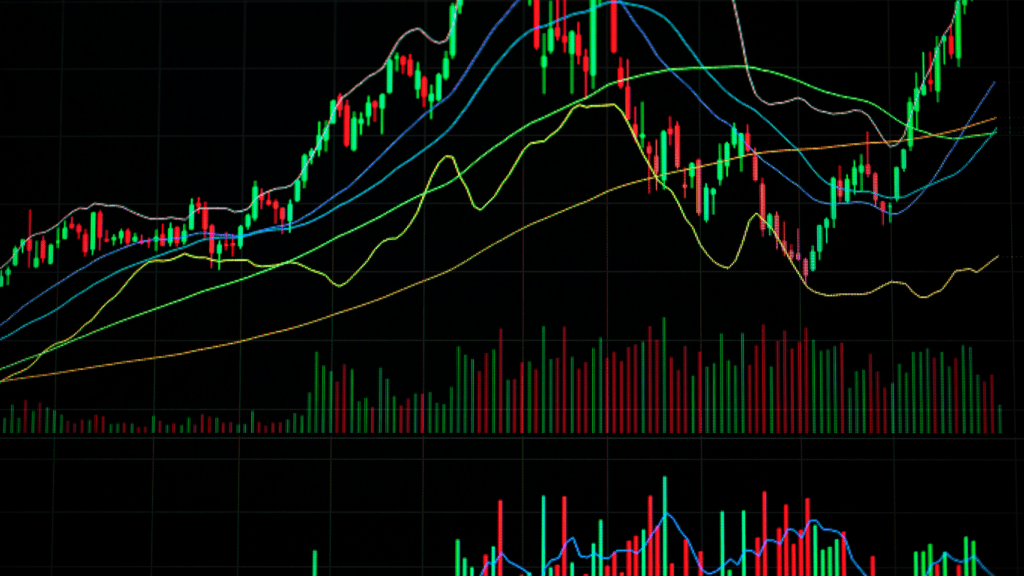

Stock markets, for instance, reflect investor sentiments and economic forecasts. Major indices like the S&P 500 or NASDAQ show fluctuations based on company earnings reports or geopolitical developments. Technology stocks often lead the way due to their rapid growth potential.

Bond markets provide insights into interest rate trends set by central banks. Current lower rates encourage borrowing, but speculation about future rate hikes impacts bond prices and yields. Investors track the Federal Reserve’s policy statements for guidance.

Commodity markets show prices driven by supply and demand factors. Crude oil, gold, and agricultural products illustrate how global production disruptions or policy changes can influence prices. Oil prices often react to OPEC’s decisions or geopolitical tensions in production regions.

Currency markets, where foreign exchange rates are determined, move with economic announcements and interest rate adjustments. The US dollar’s strength or weakness has global implications, affecting import and export balances and purchasing power.

Understanding these components is essential for analyzing market performance and identifying investment opportunities. Recognizing the ever-changing nature of these markets helps refine strategies to manage risks and exploit growth areas more effectively.

Recent Trends in Global Markets

Global markets display intricate trends influenced by diverse factors. Staying informed about these shifts is crucial for navigating today’s financial landscape.

Rise of Digital Currencies

Cryptocurrencies are gaining prominence as significant players reshape transaction and investment norms. Bitcoin and Ethereum, two leading digital currencies, have driven interest in blockchain technology. The proliferation of central bank digital currencies (CBDCs) also reflects a growing trend toward the digitization of money. Many governments and financial institutions explore these digital options, aiming for faster, cost-effective transactions and enhanced security.

Changes in Interest Rates

Interest rates play a pivotal role in global markets, influencing borrowing costs and investment returns. Central banks, such as the Federal Reserve and the European Central Bank, adjust rates to control inflation and stimulate growth. In recent years, the historic lows in interest rates stimulated economic activity, but recent adjustments reflect efforts to curb inflation. These rate shifts impact stock and bond markets, affecting economic strategies worldwide.

Impact of Geopolitical Events

Geopolitical events have immediate and far-reaching effects on market dynamics. Trade tensions, such as those between the US and China, create uncertainty and influence market stability. Conflicts and diplomatic changes can disrupt supply chains, impacting commodity prices and investment flows. The ongoing geopolitical scenario requires investors to remain vigilant, adapting portfolios to mitigate risks and capitalize on emerging opportunities.

Sector-Specific Highlights

Financial markets today bring diverse developments across various sectors, necessitating a keen eye on specific trends to harness opportunities. Here, I delve into key movements and innovations shaping finance, real estate, and commodities.

Technology and Innovation in Finance

Technology is revolutionizing finance, with fintech firms transforming traditional banking and investment services.

- Digital wallets and online platforms streamline transactions, making them more efficient and accessible.

- Blockchain technology underpins cryptocurrencies and smart contracts, offering transparency and security.

- Artificial intelligence enhances data analysis and predictive modeling, aiding in risk assessment and investment strategy development.

Real Estate Market Developments

Real estate markets experience dynamic shifts, influenced mainly by interest rates and demographic trends.

- Urban areas see increased demand for mixed-use developments, reflecting the rising preference for live-work-play environments.

- Remote work trends impact commercial real estate, with demand for office space shifting toward flexible leasing options.

- Sustainability becomes a focus, with developers incorporating green building practices and energy-efficient designs to meet regulatory standards and consumer expectations.

Trends in Commodities and Natural Resources

Commodities and natural resources markets face significant volatility driven by supply chain disruptions and geopolitical events. Energy markets witness fluctuating oil and gas prices due to changes in production agreements and geopolitical tensions. Renewable energy sources like solar and wind gain investment traction, reflecting a global shift toward sustainable energy. Agricultural commodities experience price variations based on climate conditions and trade policies, requiring stakeholders to continually adjust strategies.

These sector-specific highlights offer a window into the multifaceted landscape of financial markets, each element contributing to broader economic shifts.

Role of Regulatory Changes

Regulatory changes significantly shape financial markets, influencing investor confidence and market stability. When new regulations are introduced, they can impact how financial institutions operate. For example, the Dodd-Frank Act, implemented after the 2008 financial crisis, imposed stricter capital requirements on banks to reduce systemic risks.

Governments and financial bodies regularly update rules to address emerging challenges. Cryptocurrency regulations, for example, are evolving to ensure security and reduce fraud risk. In Europe, the Markets in Financial Instruments Directive II (MiFID II) aims to increase transparency and protect investors by refining trading practices and ensuring fair markets.

Regulatory changes often target enhancing consumer protection and promoting fair competition. Enhanced data privacy measures, such as the General Data Protection Regulation (GDPR) in the EU, protect individual financial information, fostering trust in digital transactions. Such policies help balance innovation with safety, ensuring that markets remain both vibrant and secure.

Adapting to regulatory changes presents both challenges and opportunities for market participants. Compliance costs can rise, but regulatory clarity can attract new investments, especially in emerging sectors like green finance. This creates a dynamic interplay where investors and institutions must remain agile.

Investor Sentiments and Behavioral Shifts

In today’s financial landscape, investor sentiments influence market movements significantly. Economic data releases, corporate earnings, and geopolitical news each prompt swift reactions from investors. When I observe shifts in market trends, it’s often due to the collective behavior of shareholders facing new economic realities. For example, data from the American Association of Individual Investors shows fluctuating levels of optimism and pessimism among traders, which directly correlates with market volatility.

Behavioral shifts also occur as investors adapt to digital finance innovations. With the increasing popularity of digital currencies and trading platforms, many investors often shift from traditional asset classes to alternative investments like cryptocurrencies. In fact, according to research from Chainalysis, global crypto adoption increased by over 880% year-on-year, indicating a notable behavioral shift toward digital assets.

Another key trend is the growing emphasis on environmental, social, and governance (ESG) criteria in investment decision-making. Investors are now more inclined to align their portfolios with sustainability goals, influencing both market demand and corporate strategy. The rise in ESG-focused investing drives companies to improve their sustainable practices, further solidifying the behavioral change within investment communities.

Overall, understanding investor sentiments and behavior is crucial for predicting market trends and navigating today’s complex financial environment.

____________

____________